You can accept PayPal as follows

To be able to accept PayPal in your own online shop, a PayPal business account must be opened or an existing (private) PayPal account must be extended accordingly.

This guide explains how to accept payments with PayPal. How to open a business account with PayPal, what information has to be provided to PayPal (set up PayPal) and how to store the technical details (API data) in the online shop.

To make this step-by-step guide easier to understand, we have illustrated it with pictures from the PayPal site. PayPal changes the visual appearance of its pages regularly. So it may be that the pages look a bit different now, but the navigation and the names of the buttons usually do not change.

Open a PayPal business account

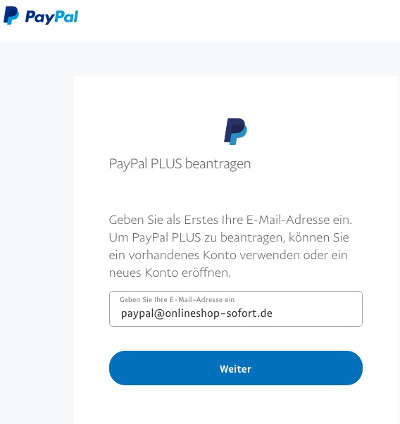

Go to the website: https://www.paypal.com/business and start opening a Paypal business account there.

It opens the area to open a PayPal Plus account.

At this point you have the possibility to use an already existing PayPal account or create an additional account to separate private and business.

We recommend that you open another PayPal account for your business.

Your Personal PayPal account should be used for PayPal payments, while the Business PayPal account is used for receiving PayPal payments.

To open the Business PayPal account, please use an email address with the domain of your website, such as onlineshop@your-Domain.com.

Create PayPal Business Account

If you don’t have a PayPal account yet, you have to create a PayPal account now and log in and verify yourself.

Then you have to think of a password that consists of at least 8 characters, of numbers and letters and special characters.

Then you will be taken to the page where you have to enter your business data.

The business contact is the first and last name of the business owner. Then the official company name, as well as the telephone number of the shop and the postal address.

Then you agree to the agreement by ticking the boxes and clicking on Agree and open account.

deposit a bank account

A bank account must be linked behind the business PayPal account. The PayPal payments are later settled via this bank account. You can pay via this bank account with your suppliers, for example with PayPal.

You will later also receive the credits from the online sales to this bank account.

If you define a bank account, note that the account holder must be identical to the name of the transaction.

This bank account is verified by PayPal. For this purpose PayPal transfers two small amounts, which are worth less than one Euro. Usually a few cents.

After you have deposited your business bank account with PayPal, you should wait about 24 hours and then check your bank statement. There the two transfers should then have been credited.

Then log back in to PayPal and confirm the bank account. You do this by entering the two transfer amounts at PayPal. This confirms that you have access to the bank account. So the authorized account holder are.

Set up a PayPal business account

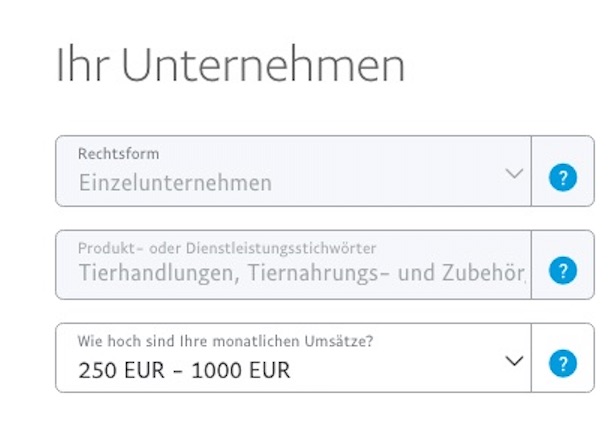

When you set up a business account, PayPal asks for some information about the company.

The first field must indicate which legal form is involved. As a rule, one uses a sole proprietorship or a corporation in the form of a GmbH.

In the second field you describe the offered products in some keywords.

This is followed by the information on the monthly turnover that is to be generated with PayPal.

Here one should not exaggerate or understate unnecessarily. If the actual sales differ from the information provided here, PayPal may have to contact you at a later date, which may result in delayed payouts.

Then further information on the company is requested

The date of incorporation can be found as a sole proprietorship in the business registration and as a GmbH in the excerpt from the commercial register.

If it is a GmbH, then the commercial register number must be entered in the following field. Even if the field is optional, this field should be filled in to avoid delays in payouts later.

The same applies to the details of the sales tax identification number (VAT ID number). The sales tax identification number, also known as MwSt-Ummer, begins in Germany with DE and is followed by 9 numbers. Ask your tax consultant if you do not have these details to hand. If you are unsure, check your own VAT identification number on the website of the European Commission: https://ec.europa.eu/taxation_customs/vies/

You must also publish this information in the imprint on your own website.

Then the information is given what PayPal should tell the customers about your shop.

On the bank statement of your customers, the purchase will be displayed in your shop. Then first the word Paypal and then the name of the shop.

You have a total of 11 characters to select a unique “debit card billing name”. When you select the name, you put yourself in the position of your customer. How does your customer perceive the shop? Perhaps it is rather the internet address and the name, how you present yourself in the online shop and less the name that appears in the extract from the commercial register.

In the Company name field, you now have a little more space and can enter the name that should appear on the invoices and receipts at the customers.

The debit card billing name appears on the customer’s bank statement and the company name information appears on the receipts sent to the customer by PayPal via email.

Then you will be directed to the website of the online shop. This is the website where the PayPal payment will be made later.

You may only accept PayPal payments through the online shop that you specify at this point.

Should you later operate other online shops under a different internet address or move the online shop to a different website, please be sure to inform PayPal.

Any misrepresentation will be interpreted by PayPal as fraud and can lead to significant complications with payouts.

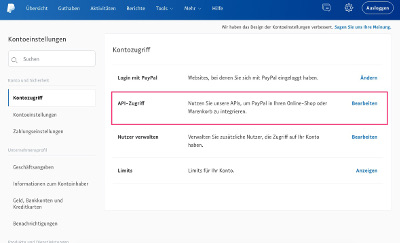

Create PayPal API access

In order to be able to accept PayPal in its online shop, the online shop must be informed to which PayPal account the credit should be made.

To do this, you store the so-called API key in your online shop. This API key is individual for each merchant and can be requested in the PayPal backend.

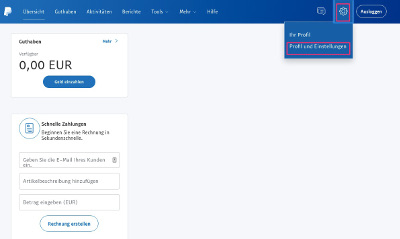

After the PayPal business account has been successfully set up, the PayPal overview page looks something like this.

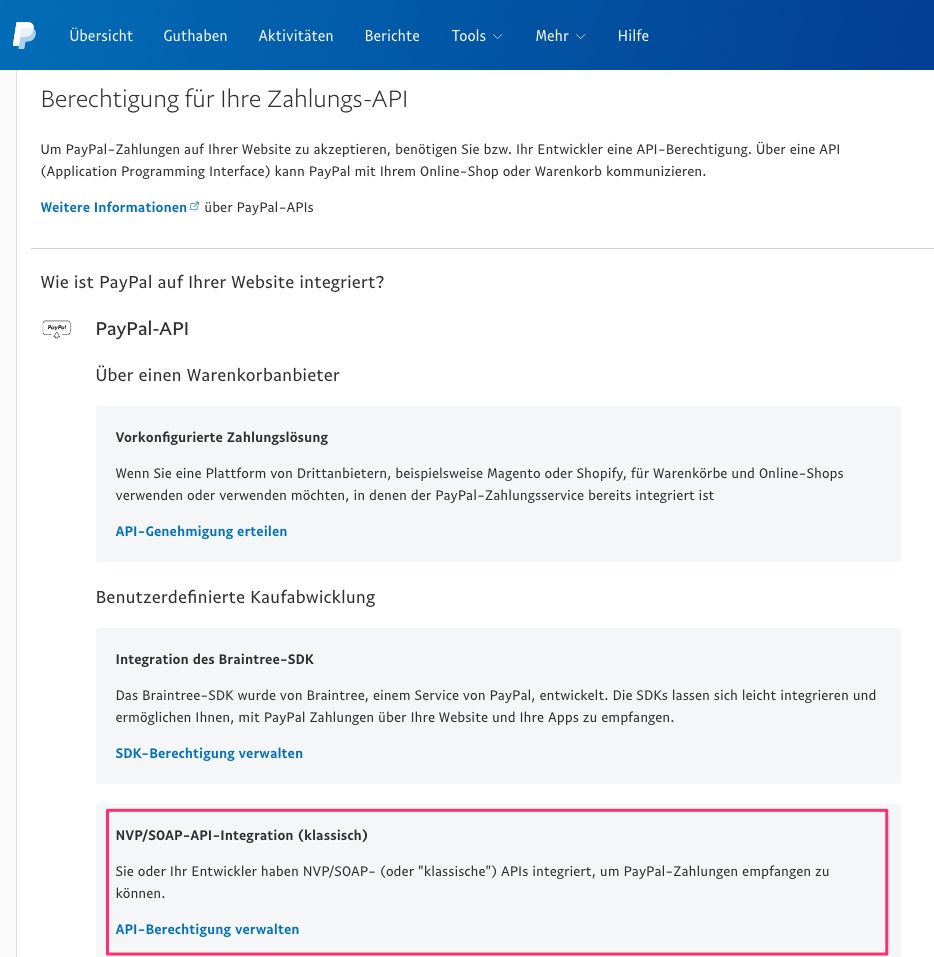

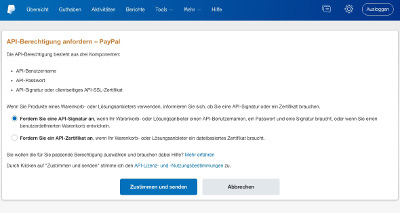

After clicking on Edit, you will be taken to the page with the label:

“Authorization for your payment API”.

There you scroll down a bit until you reach the section: “2NVP/SOAP API integration (classic).

There you click on Manage API Permission.

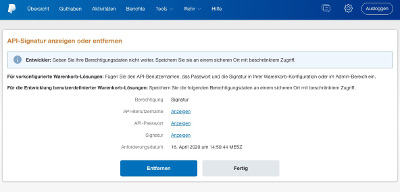

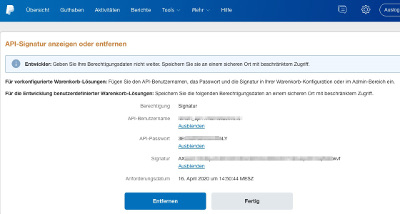

PayPal API Key

The three required information are displayed here. In each case once again protected behind the word ads.

- API-Username

- API-Password

- Signatur

The respective details are required and must be stored in the online shop.

After the PayPal data has been stored in your online store, you should make a live test order with your own private PayPal account. So you can check if the payment will be processed successfully.

Please do not forget to check your bank account after 2-3 days. A payment receipt for PayPal bank account certification should have been received here. To do this, log into the PayPal business account with your PayPal business account email address and confirm receipt of payment.

Paypal immediately activates the account and allows payment processing. Also, be prepared for PayPal to ask for more documentation about your company and business at a later date.

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.